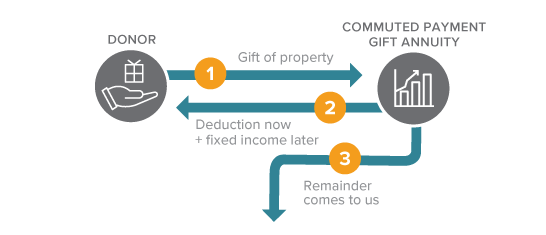

Commuted Payment Gift Annuity

How It Works

- You transfer cash or securities to Yale University. Our suggested minimum gift requirement is $10000.

- Beginning on a specified date in the future, Yale begins to pay you, or up to two annuitants you name, fixed annuity payments for a period of years that you determine.

- Beneficiaries are recommended to be at least 65 to begin receiving payments and must be at least 40 to fund the gift.

- The remaining balance passes to Yale at the end of the term of years.

Benefits

- Commuting payments permits a higher annuity rate and generates a larger charitable deduction.

- You can target your annuity payments for the period of years when you need them, such as between retirement and when you are eligible for full Social Security benefits.

- The shorter the period of payments, the higher each payment will be.

Next

- More details on Commuted Payment Gift Annuities.

- Frequently asked questions on Commuted Payment Gift Annuities

- Contact us so we can assist you through every step.

Have Questions?

Planning your estate and legacy for future generations, including your charitable interests, takes careful evaluation. Consulting with the appropriate professionals can assist you.